Pak-Austria Fachhochschule: Institute of Applied Sciences and Technology (PAF-IAST) established in September 2019 is based on the slogan of “Skilling Pakistan” to create a high-quality technical education infrastructure in the background scenario of CPEC. This unique educational Institute in Pakistan closely collaborates with several institutions in Austria and China where multiple foreign degrees will be awarded. This is a historic and visionary initiative as it is probably the first time, that an institution is established in Pakistan with multiple foreign universities giving degrees to students who study in it. This will play a pivotal role in meeting the demand for highly skilled and technically trained human capital in Pakistan especially in the fields of Artificial Intelligence, Nanotechnology, Environment Energy, Agriculture Food Technology, Railway Engineering, Mineral & Mining Engineering, etc.

Special Technology Zone (STZ) at Pak Austria will create enormous opportunities not limited to the technology industry, engineering, Biomedical sciences, food processing and packaging. These initiatives tend to create jobs for the youth, improve human capital development, foster innovation and create and support the technology and knowledge ecosystems in Pakistan. Whereas collaboration with silicon valley based partners will facilitate build partnership mentor start ups for commercialization both parties have identified complementing synergies for a tangible exponential outcome.

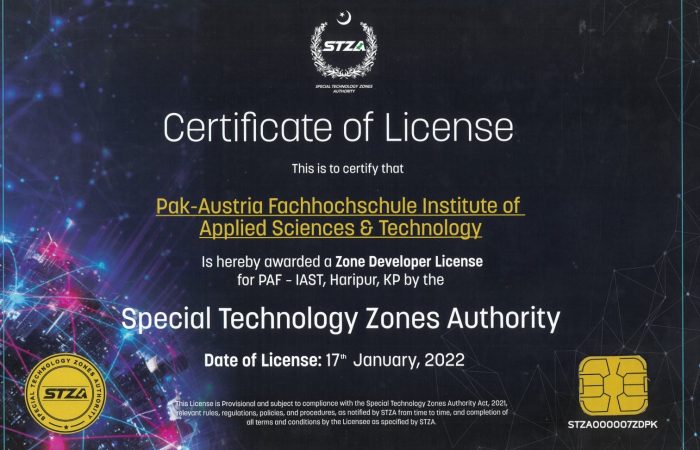

PAF-IAST has been awarded Special Technology Zone (STZ) status approved and notified by the STZA, through which the technology-driven knowledge ecosystem will be supported and special incentives for investors will be provided. The PAF-IAST programs are closely integrated with a parallel program for the development of technology-driven enterprises with STZ status has even more relevance. Dedicated STZ zone is located on the western flank of the PAF-IAST campus includes new towers with developed infrastructure around 154,000 sq. ft space with access to around 20 acres of land. For the holistic achievement of the concept, it is necessary to dovetail the institute’s educational infrastructure with a corresponding and compatible growth in the high-technology industry in tandem befitting at the STZ on campus. To meet this critical need, PAF IAST has comprehensive plan in place envisaged to provide platform includes Innovation Technology Park for the indigenous development of export-oriented technology solutions through incubation transforming inventions into innovations resulting in company spin-offs. Dedicated PAF-IAST STZ holds strategic access to nearby dry port in Havellian, Hattar industrial special economic zone (SEZ) whereas PAF-IAST is just 3 kms off the CPEC Hazara motorway while technology clusters to be developed are within the vicinity will have high demands of skilled human capital, and knowledge infrastructure will comprise of

In recognition of the crucial need to harness the opportunities of the digital age, the Prime Minister issued a mandate to establish the Special Technology Zones Authority (STZA).

STZA to provide legislative and institutional support for the development of the national technology sector. STZA operates under the Cabinet Division of Government of Pakistan, developing technology-driven knowledge ecosystem and encourage modern innovative solutions and futuristic entrepreneurship.STZA is proactively pursuing PM’s mandate developing Special Technology Zones (STZs) across Pakistan, providing special incentives to attract investors, builders and technology companies, Academia to partner with the government, and also provide a one-window facilitation to local and international companies in the STZs.Ultimately, the Authority aims to build knowledge ecosystems that will harness Pakistan’s IT and Engineering Advanced manufacturing potential and set the country on the trajectory of an entrepreneurial, innovative, and tech-driven future for shared prosperity & inclusive growth.

The Special Technology Zones Authority (STZA) has been set up under the Cabinet Division to develop a technology-driven knowledge ecosystem and encourage innovation and futuristic entrepreneurship. STZA will enable development of Special Technology Zones (STZs) across Pakistan and provide special incentives to attract investment in the technology sector. The Authority is also mandated to provide institutional and legislative support for the technology sector.

STZA is focused on several key objectives:

1. To provide institutional and legislative support for the technology sector that’s internationally competitive, export-oriented structures and facilitate evolve ecosystem;2To attract foreign direct investment;

3. To develop collaborative ecosystem;

4. To connect academia, research and technology industry;

5. To initiate innovation in production, systems and products;

6. To increase the standards and quality of technology goods and services;

7. To increase productivity;

8. To ensure competitive costs of production through high-tech interventions;

9. To have intensive innovation and futuristic entrepreneurship;10. To enable job creation; and

11. To commercialize technological knowledge.

Special Technology Zones (STZs) are ring-fenced areas, approved and notified by the STZA, through which the technology-driven knowledge ecosystem will be supported and special incentives for investors will be provided. These zones may be new, existing, or expansion of existing areas. They will be located in key hubs across Pakistan, with strategic access to existing technology clusters, human capital, and knowledge infrastructure. They will comprise of:

1. Information Technology (IT) Parks,

2. Software Technology Parks,

3. Business Process Outsourcing (BPO) Complexes,

4. R&D facilities,

5. companies specializing in emerging and new technologies,

6. Universities and Training Centers, and Centers of Excellence for tech-driven businesses and startups engaged in providing IT & IT enabled Services (ITeS).

Under the Special Technology Zones Ordinance, 2020, the STZA offers a range of special incentives for investors in the form of Zone Enterprises and Zone Developers. These incentives are to built on the concept of High-Tech Special Economic Zones (SEZs) and innovation clusters around the world, but are designed to specifically facilitate the modern dynamics of the technology sector in Pakistan. They include a range of fiscal, monetary and performance incentives including but not limited to tax exemptions, special forex and capital regulations, and targeted investment facilitation through the One Window facility. These include, but are not limited to, the following: ○ Exemption from all income taxes (withholding tax, presumptive tax) for a period of ten years from the date of issuance of a license by the STZ Authority;

1. Exemptions from all customs duties and taxes on capital goods including but not limited to materials, plant, machinery, hardware, equipment, and software imported into Pakistan.

2. Exemption from property tax for ten years from the date of issuance of a license by the STZ Authority.

3. Exemption from general sales tax (G.S.T) on goods and services on import of plant, machinery, equipment, and raw materials for the consumption of these items within zones by the Authority as well as zone enterprises.

4. Tax exemption on dividend income and long-term capital gains from investments in a venture capital (VC) undertaking for a period of ten years from the date of issuance of the license by the Authority.

5. Guaranteed high-speed internet for the companies

Zone Enterprises are the main drivers of Special Technology Zones, and will work by operating and managing a technological enterprise within the zone as licensed by the Authority.

The term refers to any public, private, or public-private legal entity that will invest, operate, and /or function within the Special Technology Zone. A Zone Enterprise is the main customer of the Special Technology Zone.

A Zone Enterprise may develop and /or operate its facility and/or physical infrastructure for its own use; however, it cannot sublease or rent-out the facility to another Zone Enterprise.

Zone Enterprises must be licensed by the STZA.

In order for a Zone Enterprise to be eligible for a license, it should preferably be engaged in the following categories: R&D, operations, development, financing, and investment in;

1. Artificial Intelligence and Machine Learning, 2. Big Data Analytics, 3. Quantum Computing, 4. Cloud Computing, 5. Internet of Things (IoT), 6. Robo Advisory, 7. Distributed Ledger Technology (DLT), 8. Natural Language Processing (NLP), 9. Augmented Reality / Virtual Reality (AR / VR), 10. Robotics, 11. Wearables, 12. Mobile Payment, 13. Fintech and Block chain, 14. Biotech and Genomics, 15. Edtech, 16. Science and or Technology Institution,

17. Technology Skill Development Centers, 18. Telemedicine, Biomedical Technology, 19. Internet of Things (IoT), 20. 3D-Printing, 21. Electric Vehicles, 22. Automobiles, 23. Sustainable and Renewable Energy, 24. Green Energy, 25. Agri-Tech, 26. Converging Technologies, 27. ICTS, IT and ITeS, 28. Nanotech, 29. Medical Devices, 30. Pharmaceutical, 31. Creative Industries. 32. Ed-Tech, 33. Semiconductors, 34. Ecommerce, 35. Satellites, 36. Electronics, 37. Smart Phones and Laptops, 38. Fine Chemicals, 39. New Materials, 40. Precise Instruments, 41. Environmental Technologies, 42. Tertiary Industries, 43. other major S&T industrial domains, 44. Industries, and other existing sectors and upcoming or emerging digital and technology areas.

Company(s) can apply to PAF-IAST for an allotment of office space, stz.info@paf-iast.edu.pk

Zone Enterprises whose business is not core tech (one of the categories mentioned above) and are ancillary to tech businesses or providing general commercial services (such as hotels, restaurants, eateries, postal services etc.) should send a letter of interest to applications@stza.gov.pk . PAF-IAST is working on the logistics will open applications for these types of Zone Enterprises at a future date TBA.

Zone Enterprises will be evaluated based on their contributions to Pakistan’s technology sector, with factors such as R&D, local job creation, technology transfer, human capital development, exports growth, import substitution, technology development and other relevant areas. For a more detailed framework, please refer to STZA (Qualification and Approval) Rules, 2021.

The terms refer to any public, private, or public-private legal entity that will establish, develop, operate, manage, and/or maintain an entire or a part of a Special Technology Zone. The Zone Developer may lease or rent out its facility to licensed Zone Enterprises. The Zone Developer will be responsible for the supervision of activities in its Zone and monitoring compliance with the relevant agreements, licenses, and the Rules and Regulations notified by the Authority. Additionally, the respective entity will have to ensure equal treatment in the delivery of services to Zone Enterprises.

Zone Developers will be evaluated based on their technical and financial proposals. The interested applicants are requested to refer to Annexure I, II, III, and V of the Special Technology Zones Authority (Qualification and Approval) Rules, 2021 for a detailed overview of the selection criteria.

Interested Zone Enterprises will be required to submit an Application, Authorization letter of the Focal Person, Company Profile, Business Plan, and Audited Financials of the past 3 years (if applicable). Proof of paid application fee will also be required. Please refer to the “Apply Now” page for details. Hyperlink

Zone Enterprises are charged an initial Application Fee, and if successful will pay an Annual License Fee.

Zone Enterprises will also pay rent (in case of office space requirement only) or lease land (in case of those entities desiring to build own-use facilities) to Islamabad Technopolis.

The Application Fee for Zone Enterprises depends on the size or stage of the Zone Enterprise as well as the category (or type) of the ZE. These fees go towards application processing and are non-refundable. Details are given in the tables below:

Size / Stage of Zone Enterprise | Number of Employees or Revenue (PKR & USD)* | Application Fee (PKR & USD)* |

| ||

Startups | Employees 1-20 Revenue < PKR 500 Million (Revenue < USD 3 Million) | PKR 16,000 (USD 100) |

SMEs | Employees 21-250 Revenue PKR 500-1000 Million (Revenue USD 3-6 Million) | PKR 160,000 (USD 1000) |

Large Enterprises | Employees 251-1000 Revenue PKR 1-16 Billion (Revenue USD 6-100 Million) | PKR 480,000 (USD 3000) |

Anchor Tenants | Employees 1000+ Revenue > PKR 16 Billion (Revenue > USD 100 Million) | PKR 800,000 (USD 5000) |

If you have any questions, please do not hesitate to ask us. Please also call us or email us before visiting to make sure that you will be served with our best services.

0995-111 723 278

stz.info@paf-iast.edu.pk